income tax malaysia rate

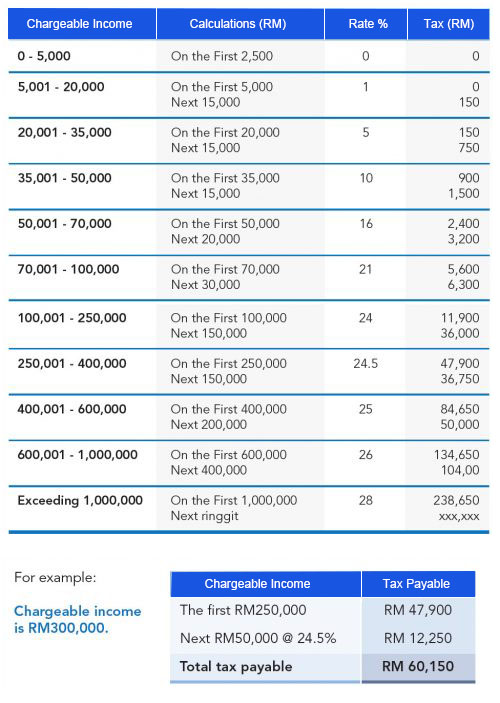

B Gains profit from employment. On the First 2500.

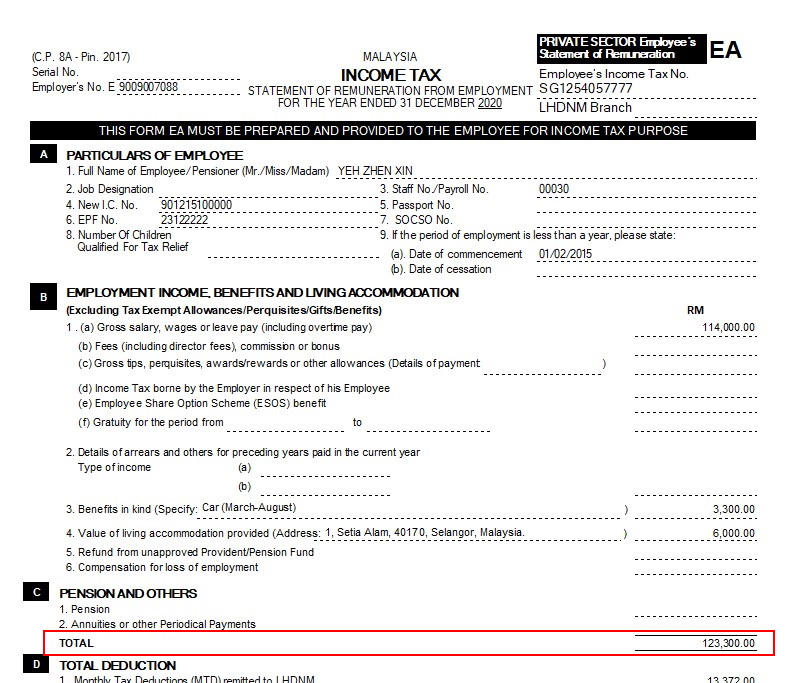

Understanding Tax Smeinfo Portal

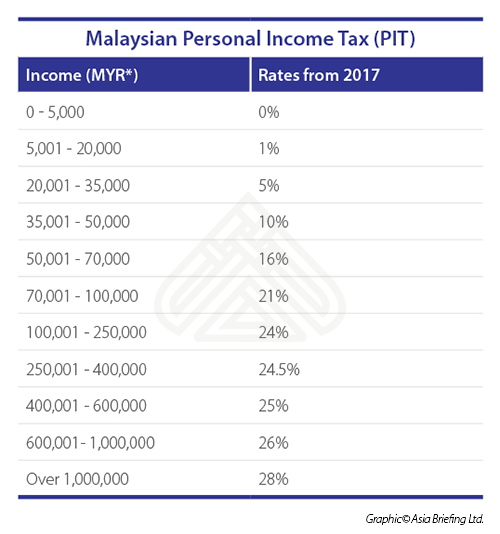

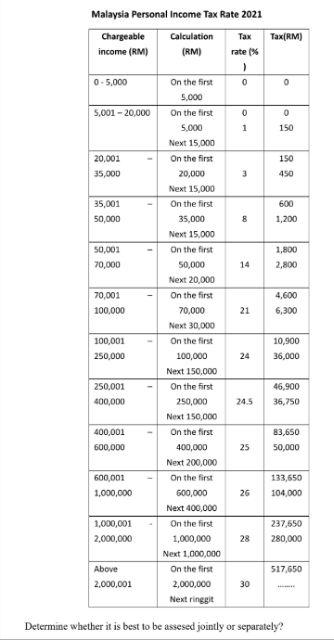

Taxable income band MYR.

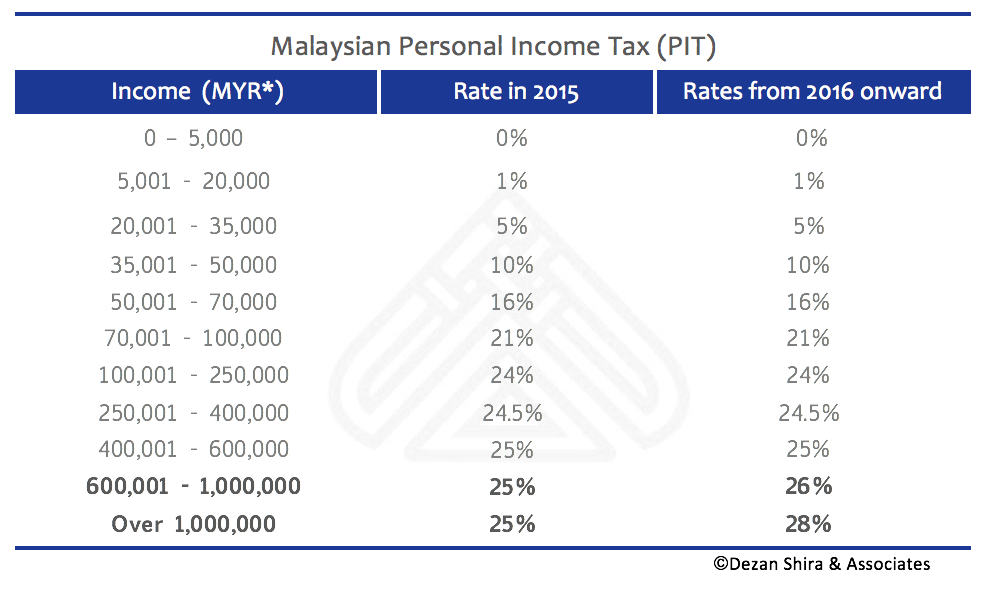

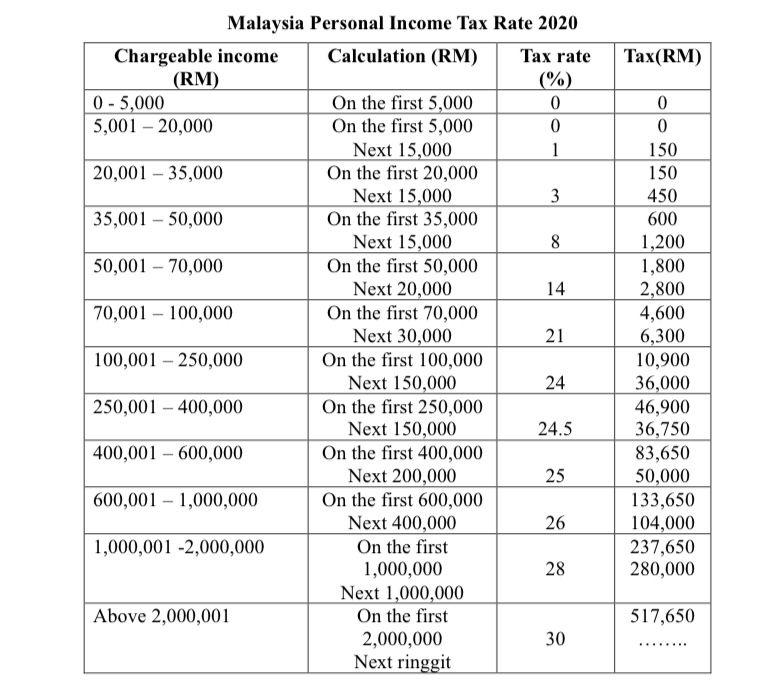

. Tax Rates for Individual Assessment Year 2020. C Dividends interest or discounts. Additionally the tax rate on those earning more than RM2 million per year has been increased from 28 to 30.

Therefore if youre a very busy person. 13 rows 30. A non-resident individual is taxed at a flat rate of.

Assessment Year 2020 Individual Taxable Income for the first RM35000 is RM900 and calculate on 10 for the next RM15000 of total income. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040. On the First 5000 Next 15000.

Taxable income band MYR. On the First 5000. Malaysia has a territorial tax.

Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the. On the First 5000. The Malaysian corporate standard income tax rate is 24 applicable to resident or non-resident companies that earn revenue inside Malaysia.

However non-residing individuals have to pay tax at a flat rate of 30. The first 5000 MYR earned is tax free with tax being applied on a progessive basis for any income above this. According to the Inland Revenue Board Of Malaysia LHDN failure to pay your taxes on time will incur a 10 increment on your payable tax.

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Additional rates will be implemented in case of special instances of income. Calculations RM Rate TaxRM 0 - 5000.

Chargeable Income Calculations RM Rate TaxRM 0 2500. Petroleum income tax Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. On first RM600000 chargeable income 17 On subsequent chargeable income 24 Resident company with paid-up capital above RM25 million at the beginning of the basis period 24.

Inland Revenue Board of Malaysia 10Y 25Y 50Y MAX Chart Compare. Taxable income band MYR. Malaysia Personal Income Tax Rate Download The Personal Income Tax Rate in Malaysia stands at 30 percent.

Malaysia Residents Income Tax Tables in 2020. A Gains profit from a business. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around.

Residents are subject to a sliding scale of income tax rates³. However if you claimed RM13500 in tax. This translates to roughly RM2833 per month after EPF deductions or about RM3000.

If taxable you are required to fill in M Form. This will be in effect from 2020. Annual income RM36000.

An effective petroleum income tax rate of 25. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold. Total tax reliefs RM16000.

Personal Tax 2021 Calculation. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30. On the First 20000 Next.

Tax reliefs and rebates There are 21 tax reliefs available for individual. Tax is imposed annually on individuals who receive income in respect of. Any individual earning a minimum of RM34000 after EPF deductions must register a tax file.

Ali work under real estate company with RM3000 monthly salary. Malaysia Residents Income Tax Tables in 2022.

St Partners Plt Chartered Accountants Malaysia Personal Income Tax Rate For Ya 2020 2020年个人所得税税率 Facebook

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

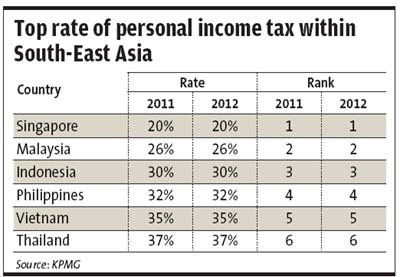

Malaysia Tax Rate Second Lowest In South East Asia The Star

Malaysian Income Tax 2017 Mypf My

Cukai Pendapatan How To File Income Tax In Malaysia

Personal Income Tax And Top Personal Marginal Income Tax Rate 2009 Or Download Scientific Diagram

Malaysian Personal Income Tax Pit 1 Asean Business News

Singapore Raises Income Tax Rates For Top 5 Per Cent And Malaysia Anilnetto Com

Finland Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Malaysia Personal Income Tax Rate 2022 Take Profit Org

13 Ehsan S Family Wants To Submit Lhdn Return Form Chegg Com

World S Highest Effective Personal Tax Rates

Withholding Tax On Foreign Service Providers In Malaysia

Comments

Post a Comment